Here's a look at several birthdays and “half-birthdays” that have implications regarding your retirement income.

Read More

Identity theft is a threat that could damage or derail your retirement. Learn how to take proactive steps to protect yourself.

Read More

The lower costs of a smaller home in retirement might sound appealing, but be ready for the trade-offs that come with making this big decision.

Read More

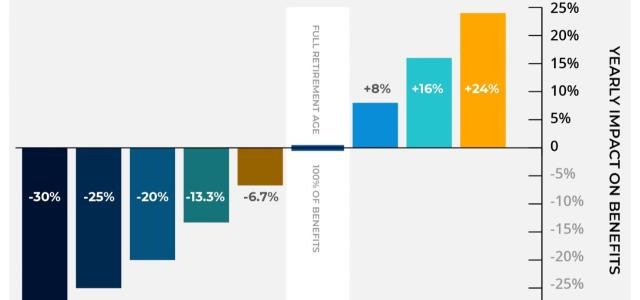

Knowing the rules may help you decide when to start benefits.

Read More

Managing your money later in life includes defining a destination point for the next generation of your wealth.

Read More

Finding an old 401(k) may seem overwhelming initially, but with a systematic approach, you can locate your funds and make informed decisions about your

Read More

Workers 50+ may make contributions to their qualified retirement plans above the limits imposed on younger workers.

Read More

Explore the potential impact Artificial Intelligence (AI) tools can have on retirees with things such as consulting or small business venture.

Read More

Learn about finding purpose in a second act and what to consider when choosing what to do in retirement.

Read More

As our nation ages, many Americans are turning their attention to caring for aging parents.

Read More

New research shows that people who develop dementia often begin falling behind on bills years earlier.

Read More

Lifestyle considerations in creating your retirement portfolio.

Read More