Understanding IRAs: A Comprehensive Overview

An Individual Retirement Account (IRA) is a financial tool offering a multitude of tax benefits for retirement savings. Whether you're already participating in an employer-sponsored retirement plan or not, an IRA can provide valuable options for securing your financial future.

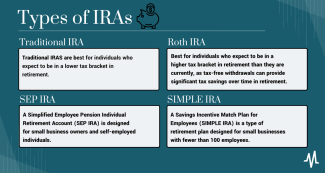

Types of IRAs

There are four main types of IRAs to consider:

1. Traditional IRA: If you have earned income or are a non-working spouse of an individual with earned income, you can contribute to a traditional IRA. Contribution limits for 2023 are $6,500 for those under 50 and $7,500 for those 50 and older. It's essential to note that federal law mandates required minimum distributions from traditional IRAs once you reach a certain age.

2. Roth IRA: Roth IRAs have income limits for eligibility and differ from traditional IRAs. Your ability to contribute to a Roth IRA depends on your modified adjusted gross income (MAGI) and tax filing status. You might consider a Roth IRA if you are in a lower tax bracket now and anticipate being in a higher tax bracket during retirement.

3. SEP vs. SIMPLE IRA: These employer-sponsored plans are suitable for business owners or employees with access to an employer-sponsored plan.

Tax Implications of IRAs

Tax considerations vary between traditional and Roth IRAs. Traditional IRA contributions may be tax-deductible, reducing your taxable income for the year. Roth IRA contributions are not tax-deductible; they comprise after-tax dollars. However, Roth IRAs offer tax-free withdrawals under specific conditions. Your choice between the two depends on your financial situation, future tax expectations, and retirement goals. It's advisable to consult with a financial advisor or tax professional to determine the most suitable IRA for your needs.

IRA vs. 401(k): Key Differences

While traditional and Roth IRAs have no age limits, contributing to a 401(k) typically requires you to be at least 21 years old and have a minimum of 1 year of service with your employer. However, 401(k) plans offer the advantage of higher contribution limits. In 2023, the maximum employee contribution is $22,500 for those under the age of 50, and $30,000 for individuals aged 50 or older. Moreover, certain 401(k) plans may allow after-tax contributions, which do not count towards the $22,500 maximum but are subject to the $66,000 limit for 2023. This overall limit encompasses both employee contributions and any employer matching or profit-sharing contributions.

In conclusion, Individual Retirement Accounts (IRAs) provide a flexible and tax-efficient means of securing your financial future in retirement. With different types of IRAs available, including Traditional and Roth IRAs, as well as employer-sponsored plans like SEP and SIMPLE IRAs, you have options that can be tailored to your unique financial situation and retirement goals.

Ultimately, the path you choose—whether it's an IRA, 401(k), or a combination of both—should align with your unique financial goals, income level, and tax outlook. By making informed decisions about your retirement accounts, you can pave the way for a more financially secure and prosperous retirement.

Schedule a meeting with us to discuss your options and decide what fits your goals and needs the best!